Can I tow a RV with salvage title?

You would have to hire a shipping company that is capable of towing over-sized items. Please try contacting www.haulmatch.com for shipping assistance. More details : How much does it cost to ship a car?

You would have to hire a shipping company that is capable of towing over-sized items. Please try contacting www.haulmatch.com for shipping assistance. More details : How much does it cost to ship a car?

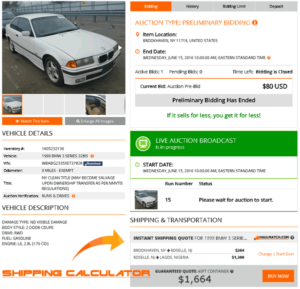

Most of the vehicle we have listed are exportable. If ever in doubt, please contact our customer service at 215-289-0300. Please use shipping calculator on every item to figure out maximum cost on the vehicle. You could also obtain a free shipping quote to Nigeria by going to www.haulmatch.com.

Most of the vehicle we have listed are exportable. If ever in doubt, please contact our customer service at 215-289-0300. Please use shipping calculator on every item to figure out maximum cost on the vehicle. You could also obtain a free shipping quote to Nigeria by going to www.haulmatch.com.

After receiving all signed documents and complete payment, we’ll notify you via email when the vehicle is ready for pick-up. The address will also be accessible in your ridesafely.com account under the ‘Pick Up Location‘ tab. Additionally, we’ll give you a call to provide further details and ensure a smooth pick-up process.

If you have completed all necessary steps but haven’t received the information, please don’t hesitate to contact our office. Reach us directly at 215-289-0300 for immediate assistance.

Thank you,

Thank you,

Team RideSafely.com

feedback[at]ridesafely.com

RideSafely’s Guide to a Seamless Payment Process

Payment Related

See all questions and answers related to the payment process.

Shipping Related

See all questions and answers related to the shipping process.

If you’re looking to buy a car from an auction and require further information, please don’t hesitate to reach out to us at RideSafely. Contact us at (215) 289-0300 for assistance. We’re dedicated to helping you navigate your auction purchase smoothly.

Thank you,

Thank you,

Team RideSafely.com

feedback[at]ridesafely.com

Customers who purchase a vehicle in Canada MUST pay taxes. If delivery takes place in Ontario, then 13% HST will apply to the sale, regardless of where the customer lives. If delivery takes place outside of Ontario, the tax applicable to that province should be charged. But what does `delivery` mean? It`s based on where the customer takes possession of the vehicle. – If the customer picks the vehicle up in Ontario and drives it home, delivery takes place in Ontario – If the vehicle is shipped out-of-province with the customer`s name showing as the shipper on the bill of lading, delivery takes place in Ontario – If the vehicle is shipped out of province with the dealer`s name showing as the shipper on the bill of lading, then delivery takes place in the destination province. Out-of-province purchasers from non-HST provinces and territories will be able to apply for a refund of the 8% provincial portion of the HST from Canada Revenue Agency, once they have registered the vehicle in their home province and paid any applicable provincial taxes. Here`s a summary of tax rates in all Canadian jurisdictions. Delivered To Tax rate in % Nova Scotia 15% Newfoundland 13% New Brunswick 13% Ontario 13% British Columbia 12% Alberta 5% Manitoba 5% North West Territories 5% Nunavut 5% Prince Edward Island 5% Quebec 5% Saskatchewan 5% Yukon 5%

Cookie Consent: By continuing to use this site you agree to our use of cookies. Privacy Policy

OKPrivacy SettingsWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refusing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Google reCaptcha Settings:

Vimeo and Youtube video embeds: